Originally posted on Electronicsweekly.com by author: David Manners 18th April 2024

Gen AI sparks IC boom, says Yole

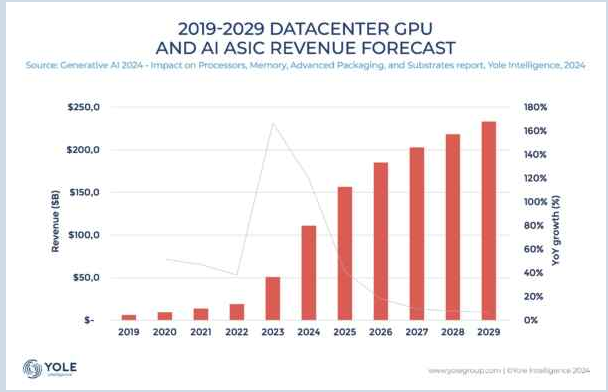

Datacentre GPU and AI ASIC revenue could reach $156 billion by 2025 and $233 billion by 2029, says Yole Developpement.

The massive growth that the data center GPU and AI ASIC market experienced in 2023 is expected to continue in 2024 before stabilising in 2025.

Generative AI’s rise since late 2022 has boosted demand for high-speed memory technologies, including DDR5 DRAM, GDDR6 DRAM, etc., as well as HBM .

Thanks to strong momentum in GPUs and ASICs for AI computing, the HBM market is booming. Bit shipments are expected to keep growing vigorously in the next five years, with a 48% CAGR between 2023 and 2029.

Generative AI’s explosion also impacts the packaging market segment: according to Yole, it will grow to $333 million in 2029.

Datacenter processor shipments for AI acceleration were growing strongly in 2023, and this trend is expected to continue in 2024 and 2025. Yole expects the datacenter GPU market to grow to $162 billion in 2029, representing an almost 26% CAGR between 2023 and 2029.

Among these datacenter GPUs, the flagship segment with GPUs such as Nvidia H100, B100, and AMD MI300, which are mainly used for generative AI training and inferences, is expected to grow.

AI ASICs are also growing strongly to a $ 71 billion market in 2029, representing a 35% CAGR.

“The decision to investigate the effect of AI in depth was triggered by the unprecedented investment from major hyperscalers in GPU and AI ASIC, which far exceeded our initial projections,” says Yole’s Emilie Jolivet, “this surge in investment was reflected in the remarkable revenue growth, with 2023 figures more than double those of 2022. At Yole Group, we anticipate a comparable growth rate for 2024, indicating a potential sustained trend that is likely to continue to reshape the industry.”

The impact of this trend extends beyond the financial aspects, significantly influencing the semiconductor supply chain. The increased demand for advanced chipsets optimised for AI workloads is impacting the existing supply chain, leading to potential bottlenecks and shortages.

Moreover, the shift towards AI-specific hardware is driving a need for new manufacturing processes and technologies, further challenging the industry.

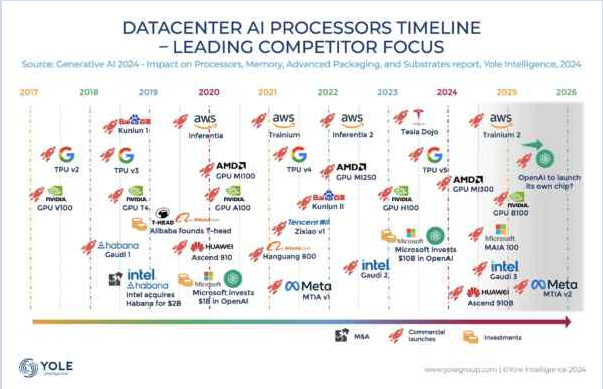

Nvidia is the frontrunner in the generative AI market, propelled by its flagship GPUs and experiencing substantial growth in its datacenter business line.

Meanwhile, AMD’s MI300 is gaining traction in the field. Major players like Google, Amazon, and Chinese BATX are forging ahead with the development of AI ASICs tailored as custom chips for internal use and cloud services. Their goal is to lessen dependence on datacenter GPUs from fabless companies, reduce costs, and harness processors designed specifically for their requirements.

This emergence of AI ASICs presents significant competition for Nvidia. Intel’s Gaudi and several startups with varied approaches are also entering the market.

“Samsung, SK hynix, and Micron are expanding their wafer capacity for HBM production to capitalise on opportunities in the AI market,” says Yole’s Adrien Sanchez, “while SK hynix currently leads the HBM market, competition is intensifying with Samsung’s involvement.”

In the advanced packaging field, Intel, Samsung, and TSMC are at the forefront of innovation in the high-end packaging market.

Despite challenges faced by IC substrate makers, optimism stems from recent investments, capacity expansions, and advancements in glass core substrate technologies.